So opening corporate / business bank accounts in Japan is hard. Super hard. This is the 4th in the series of posts. My previous post is here.

So what can we do, what should we be careful of when we apply to open a bank account? Let’s make sure we prepare carefully so that we can to give ourselves the best chance.

Here are my tips and advice from my personal experience:

- You have all the documents needed and filled in all the information correctly

Let’s start with the basics. Its a no brainer but make sure everything they ask for is ready. Especially for online banks, as they cannot see you.

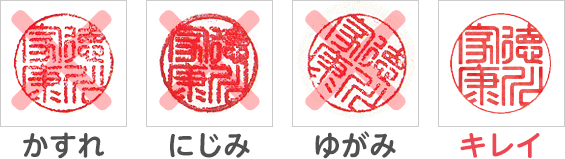

If the documents are not prepared or information missing, then they may think you / your company are unreliable. - Make sure the company seal is smooth

For those of us usually using signature (or DocuSign these days…), using stamp or company seal feels odd. But it is what it is, let’s do it properly.

Here are some examples. Make sure it is not blurred, bled, tilted.

- Check the application paper

For online banks, you usually fill in the online form and need to print it (because you need the company seal) and send it off. I have a normal inkjet printer with paper from the 100 yen shop at home. So when I printed the forms, it’s not pretty like the laser-jet printer. But that should be OK. The problem I had was that when I put my company seal on it, the ink bled…

Cutting cost is important but for bank applications, let’s get it printed properly. It will only be 5-10 yen per page (you can just print it in the convenient stores) so the application form should only cost you less than 100 yen. Its 100 yen well spent. - Capital investment is reasonable

As I have mentioned in the first post, you can now open the bank account with just 1 yen of capital investment. From the bank’s point of view, that’s not really showing much confidence in your own company.

Capital investment is something you decide when you create the company so once its set, it is not simple to change it so for some it may be too late but reading different websites, they recommend you to have around 1,000,000 yen capital investment.

I actually did not know this so my capital investment was 300,000 yen and I managed to open a bank account with Sumishin SBI bank so I guess it is case by case. But looking back, if I were to do it again, I would invest 1M JPY… - Business content makes sense

Similar to above, this is something you set when making the company so again may be too late but make sure it makes sense.

The usual advice is to make sure it is detailed enough but don’t just randomly put anything in.

For example, if your business content is just one line of “making homepages”, that’s too short… But if you have a laundry list of things that are unrelated like “making homepages”, “property investment”, “model”, “stock trader”, your bank will likely not have a clear image of what you do on a day to day basis…

FYI, this is what I have as my business content.

If you are unsure, you can ask some professional service to create one for you based on what you do. It will cost around 10,000 – 30,000 yen I think. So not too expensive. - Create a homepage

In this day and age, having a homepage is a must (in my opinion). Otherwise, the bank may think about how people are going to find out about you (especially if you do not have any physical store).

I don’t think you need anything too professional. When I applied, I only had this page (literally one page only) and was fine so just set something up (or pay to get it created as better HP will leave a better impression).

FYI, when I got rejected from Rakuten bank, I was checking the site visitors (I can do this as I was not promoting my website so the only visitor was usually just me), and they never visited my site before rejecting me… - Office address

Nowadays, there are so many rental offices and virtual offices that you can have. And some are dead cheap.

However, an application using a virtual office address will automatically be rejected when applying for bank accounts. Some banks are really clear about this so please check your bank before applying.

To me, using office address sounds professional but I guess from the banks perspective, it means you could go missing anytime (for fraud etc).

So using your home address is better. But if you are renting, make sure to check with your landlord (this is a difficult issue as a lot of landlords will say no and you have no choice but to use some virtual address…). - Phone number

Similar to the above, landlines are better than a mobile number. Trust, fraud, etc again.

When I applied to the Rakuten bank, the application would show an error if you typed in a mobile number. For Sumishin SBI, in the application form, it mentions that you can use a mobile number so I used my mobile number and managed to create an account so again do research but usually, landlines are better.

If you read around, I found an article that says Rakuten form says landline only but could type in the mobile number and this person managed to create an account and the other article I found said that Sumishin SBI specifically says no mobile number (with screenshots) so I guess policies change all the time. So make sure you check the latest policy! - Do not be afraid to send additional information

Do not be afraid to send in additional information that are not mentioned in the necessary documents. The bank wants to check to make sure you are legit so any additional information should be good.

For example, if the homepage URL is not needed in the application form, just print out your homepage and include it. If you already have an invoice, include it to show that you are doing business. - Never give up

Finally, when applying, always assume the worst.

Being rejected is a really bad feeling but expect this to happen and keep on applying to different banks. Each bank has different criteria (such as no virtual office address) so even if you get rejected from one, others may be more open.

Also, you could re-apply once your business has taken off. For example, some banks (Rakuten bank is one), require less paperwork if you have been in business for more than 6 months.

Never lose hope! Keep on applying.

So I hope this was helpful. In the next post, I will talk about my recommended online corporate / business bank. Well, I say “recommend” but this bank was the only one that I could create a bank account with. So as a thank you let me recommend it to the reader as well.

Pingback: Opening corporate / business bank account in Japan. Part 3: receiving payment from overseas | Yama-no-shita LLC consulting

Pingback: Opening corporate / business bank account in Japan. Part 5: Sumishin SBI Bank | Yama-no-shita LLC consulting